Dear Valued Customer,

This is a reminder provided for your benefit about an upcoming significant change in federal law that may affect you, IF you have a small business or are planning to start a small business in the future.

Effective January 1, 2024, Federal law — the Corporate Transparency Act (CTA) — requires certain entities, including many small businesses, to report information about the individuals who ultimately own or control them (also known as their “beneficial owners”) to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury. A separate regulatory requirement currently requires many financial institutions to also collect beneficial ownership information from certain customers that seek to open accounts as part of Federal customer due diligence requirements.

The CTA’s requirement that entities report information to FinCEN enables FinCEN to supply that information to law enforcement and other government agencies, as well as certain financial institutions. Agencies and institutions authorized to receive this information may then use it for a several specified purposes, most significantly combatting money laundering and other illicit activities that involve shell companies. Beneficial ownership collection requirements for financial institutions, in contrast, are primarily intended to ensure that financial institutions know their customers and thus can prevent their institutions from being used to facilitate illicit activity.

On December 3, 2024, the U.S. District Court for the Eastern District of Texas (the “Court”) issued a preliminary injunction blocking enforcement of the Corporate Transparency Act (CTA). As a reminder, the CTA requires that certain domestic and foreign entities doing business in the United States disclose certain information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). The Court also stayed the impending January 1, 2025, compliance deadline.

This guide answers key questions about these two separate requirements: (1) reporting beneficial ownership information to FinCEN under the CTA; and (2) providing beneficial ownership information to financial institutions in connection with Federal customer due diligence requirements. Additional information about these requirements can be found in the Resources section.

Will an entity potentially have to provide beneficial ownership information to both FinCEN and a financial institution?

Yes. FinCEN and financial institutions both collect beneficial ownership information from entities. However, they collect that information for different reasons and, in some cases, may collect different types of information. If an entity is required to report beneficial ownership information to FinCEN, that requirement cannot be fulfilled by providing beneficial ownership information to a financial institution.

For example, if an entity seeks to open an account at a bank, the bank may be required to request certain information about the entity’s beneficial owner(s) before the account can be opened. That information is collected by the bank, not by FinCEN, when fulfilling its Federal customer due diligence obligations. That same entity may separately be a “reporting company” under the CTA that is required to report beneficial ownership information to FinCEN. Additional information about the requirements for entities to report beneficial ownership information to FinCEN, including exemptions, can be found at www.fincen.gov/boi

Are FinCEN and financial institutions collecting the exact same beneficial ownership information?

No. The two charts in this guide compare the requirements. FinCEN and financial institutions do not collect the exact same types of beneficial ownership information.

For example, financial institutions are required to collect social security numbers of beneficial owners, but social security numbers are not required to be reported to FinCEN.

FinCEN began accepting beneficial ownership reports pursuant to the CTA on January 1, 2024.

If your company was created or registered prior to January 1, 2024, you have until January 1, 2025, to report.

If your company is created or registered in 2024, you must report within 90 calendar days after receiving actual or public notice that your company’s creation or registration is effective, whichever is earlier. (These dates are subject to change due to the December 2024 Injunction.)

If your company is created or registered on or after January 1, 2025, you must report within 30 calendar days after receiving actual or public notice that its creation or registration is effective. • Any updates or corrections to beneficial ownership information that you previously filed with FinCEN must be submitted within 30 calendar days. (These dates are subject to change due to the December 2024 Injunction.)

If you should have questions on Corporate Transparency Act or the Beneficial Ownership rule, please reach out to your local branch. We truly value you as a customer and thank you for being a part of the Grandview Bank family!

Jeff Williams

President | CEO

Effective January 1, 2024, many companies in the United States must report information about their beneficial owners—the individuals who ultimately own or control the company—to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

Filing is simple, secure, and free of charge. Beneficial ownership information reporting is not an annual requirement. Unless a company needs to update or correct information, a report only needs to be submitted once. Below is some information on who has to report, how has to report, and when to report.

Who Has to Report?

Companies required to report are called reporting companies. Reporting companies may have to obtain information from their beneficial owners and report that information to FinCEN.

Your company may need to report information about its beneficial owners if it is:

- a corporation, a limited liability company (LLC), or was otherwise created in the United States by filing a document with a secretary of state or any similar office under the law of a state or Indian tribe; or

- a foreign company and was registered to do business in any U.S. state or Indian tribe by such a filing.

Who Does Not Have to Report?

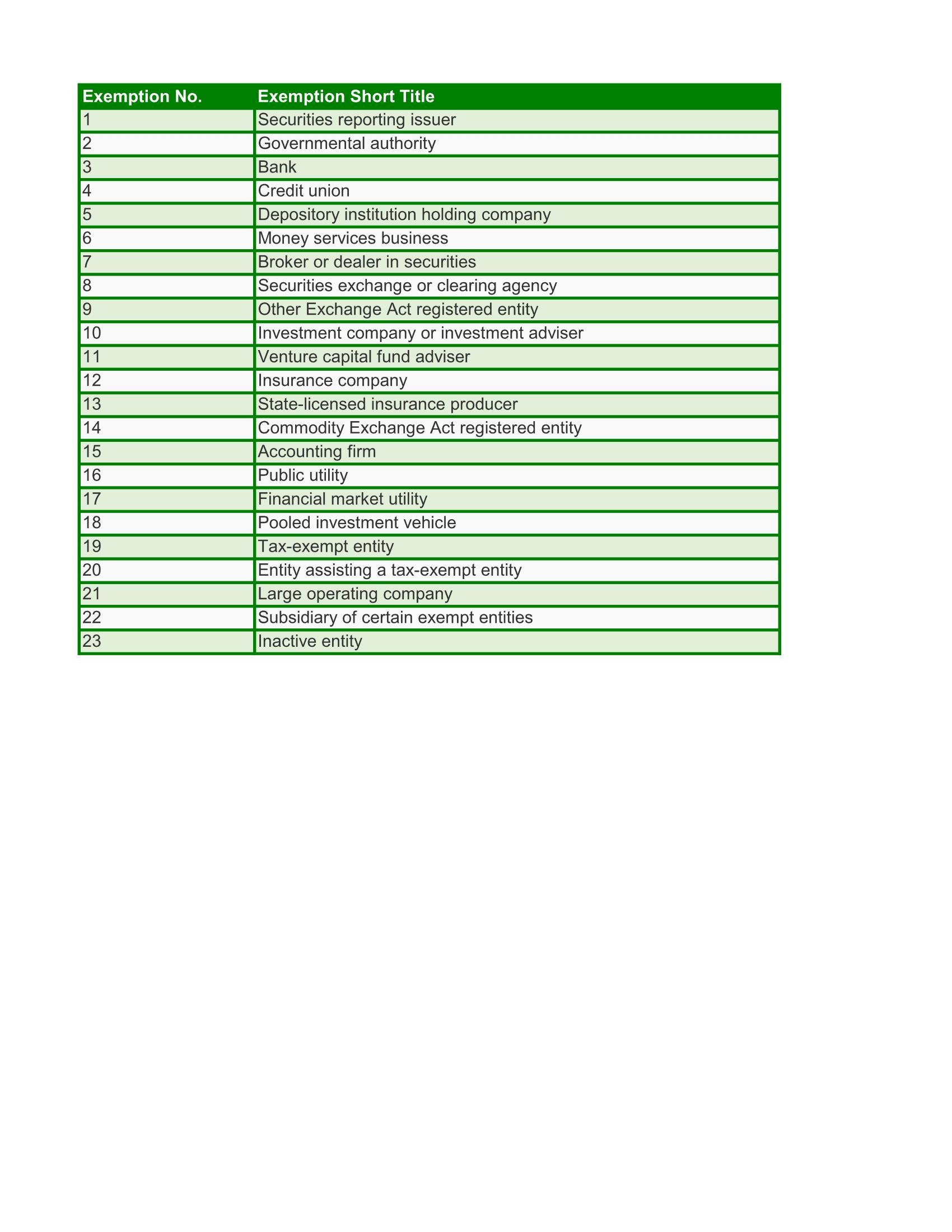

Twenty-three types of entities are exempt from beneficial ownership information reporting requirements, including publicly traded companies, nonprofits, and certain large operating companies.

The current exempt entity types are listed below:

- Securities reporting issuer

- Governmental authority

- Bank/Credit union

- Depository institution holding company

- Money services business

- Broker or dealer in securities

- Securities exchange or clearing agency

- Other Exchange Act registered entity

- Investment company or investment adviser

- Venture capital fund adviser

- Insurance company

- State-licensed insurance producer

- Commodity Exchange Act registered entity

- Accounting firm

- Public utility

- Financial market utility

- Pooled investment vehicle

- Tax-exempt entity

- Entity assisting a tax-exempt entity

- Large operating company

- Subsidiary of certain exempt entities

- Inactive entity

How Do I Report?

Reporting companies report beneficial ownership information electronically through FinCEN’s website: www.fincen.gov/boi. The system provides a confirmation of receipt once a completed report is filed with FinCEN.

When Do I Report?

FinCEN began accepting reports on January 1, 2024.

- If your company was created or registered prior to January 1, 2024, you will have until January 1, 2025 to report BOI.

- If your company is created or registered in 2024, you must report BOI within 90 calendar days after receiving actual or public notice that your company’s creation or registration is effective, whichever is earlier.

- If your company is created or registered on or after January 1, 2025, you must file BOI within 30 calendar days after receiving actual or public notice that its creation or registration is effective.

- Any updates or corrections to beneficial ownership information that you previously filed with FinCEN must be submitted within 30 days.

Below you will find information from the US Department of Treasury's Financial Crimes Enforcement Network to help give more clarity on the new Beneficial Ownership requirements.